Navigating the Market Landscape: Understanding Holidays and Their Impact on the NSE in 2025

Related Articles: Navigating the Market Landscape: Understanding Holidays and Their Impact on the NSE in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Market Landscape: Understanding Holidays and Their Impact on the NSE in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Market Landscape: Understanding Holidays and Their Impact on the NSE in 2025

The National Stock Exchange of India (NSE) operates within a dynamic ecosystem influenced by numerous factors, including holidays. While holidays are generally associated with rest and relaxation, they can significantly impact market activity and investor behavior. Understanding the nuances of holidays and their implications on the NSE is crucial for informed investment decisions.

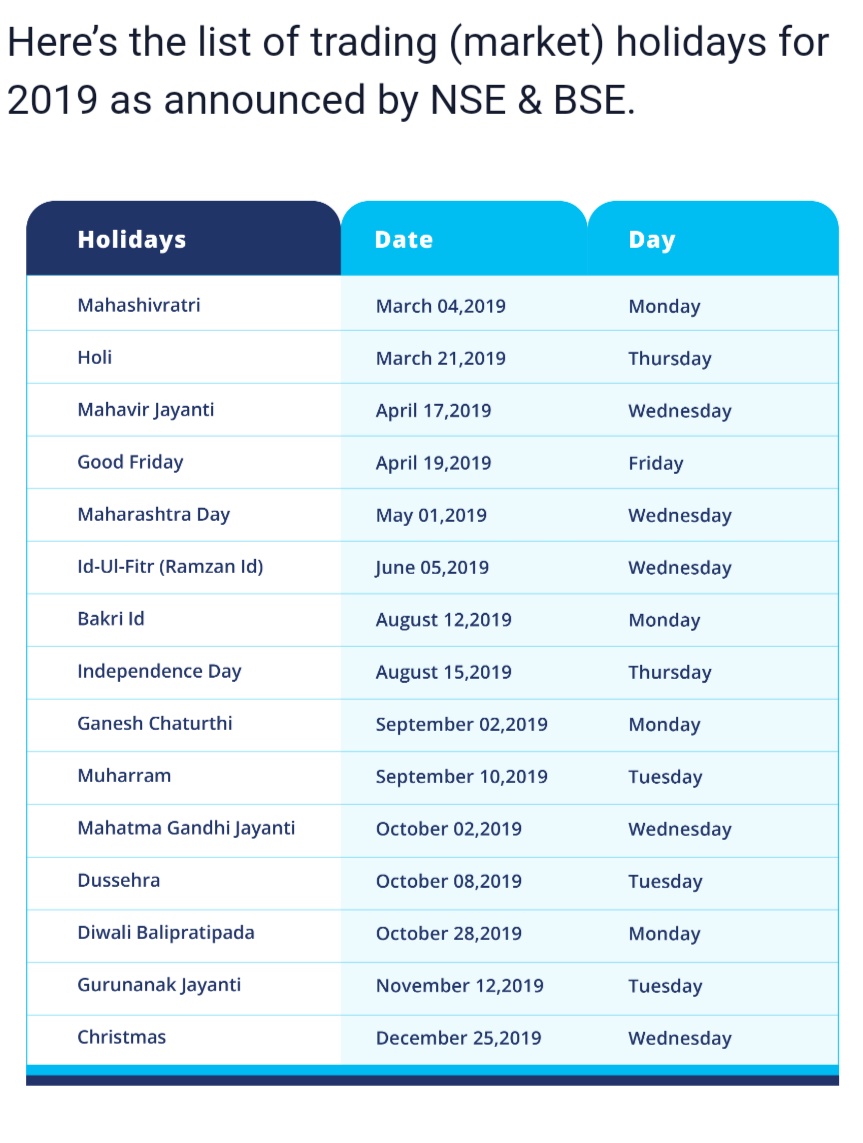

The 2025 Holiday Calendar: A Key Guide for Investors

The NSE’s trading calendar for 2025 will feature a mix of national, religious, and regional holidays. These holidays can be categorized into two primary types:

- Trading Holidays: These days mark complete market closures, with no trading activity permitted. Examples include Independence Day, Republic Day, and major religious festivals.

- Observance Days: These days may see reduced trading hours or specific market segments closed. These often include holidays observed by particular communities or regions.

Impact of Holidays on Market Dynamics

Holidays can influence market dynamics in several ways:

- Reduced Liquidity: Trading volumes tend to decrease during holidays, leading to reduced liquidity. This can result in wider bid-ask spreads and increased volatility.

- Price Fluctuations: Market sentiment can be influenced by holidays, potentially leading to price fluctuations. News events, announcements, or geopolitical developments occurring during holidays can also impact market sentiment.

- Trading Strategies: Investors may adjust their trading strategies to account for holiday periods. Some may choose to stay away from the market altogether, while others may utilize the reduced trading activity to their advantage.

Understanding the Importance of Holiday-Related Considerations

- Risk Management: Investors should be aware of the potential risks associated with trading during holiday periods. Reduced liquidity and increased volatility can amplify market risks.

- Trading Strategies: Investors may need to adjust their trading strategies to accommodate holiday-related factors. This may involve adjusting position sizes, using stop-loss orders, or avoiding certain market segments.

- Information Flow: The flow of information can be disrupted during holidays. Investors should stay informed about any news or developments that may impact their investments.

Frequently Asked Questions (FAQs)

Q: What happens to my orders placed before a trading holiday?

A: Orders placed before a trading holiday are typically carried forward to the next trading day. However, it is advisable to check with your broker for specific order handling procedures.

Q: Can I still access my trading account during a holiday?

A: You may be able to access your trading account online or through your broker’s mobile app, but trading will be unavailable during trading holidays.

Q: How can I stay informed about upcoming holidays and their impact on the market?

A: The NSE website, your broker’s platform, and financial news outlets provide updates on trading holidays and their potential implications.

Tips for Navigating the NSE During Holiday Periods

- Stay Informed: Keep track of upcoming holidays and their potential impact on market activity.

- Review Trading Strategies: Adjust your trading strategies to account for potential reduced liquidity and increased volatility.

- Use Stop-Loss Orders: Employ stop-loss orders to limit potential losses during periods of heightened market volatility.

- Monitor News and Developments: Stay informed about any news or developments that may impact your investments.

Conclusion

Navigating the NSE during holiday periods requires careful consideration and strategic planning. By understanding the potential impact of holidays on market dynamics, investors can mitigate risks and make informed decisions. Staying informed, adjusting trading strategies, and exercising caution are key to navigating the market landscape during these periods.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Market Landscape: Understanding Holidays and Their Impact on the NSE in 2025. We appreciate your attention to our article. See you in our next article!